Momentum: Financial Empowerment Programs

Community Support

Partner Spotlight

You may remember our partner, Momentum, from a few spilled beans ago! Skills Program Coordinator, Iris Assouline provided us with a great overview of Momentum’s approach to poverty reduction, economic development initiatives, and how to access their programs. As November is Financial Literacy Month, we met with Jodie Moffatt, Financial Empowerment Facilitator, to dig deeper into their Financial Empowerment Programs.

Tell us a bit about yourself and your role at Momentum.

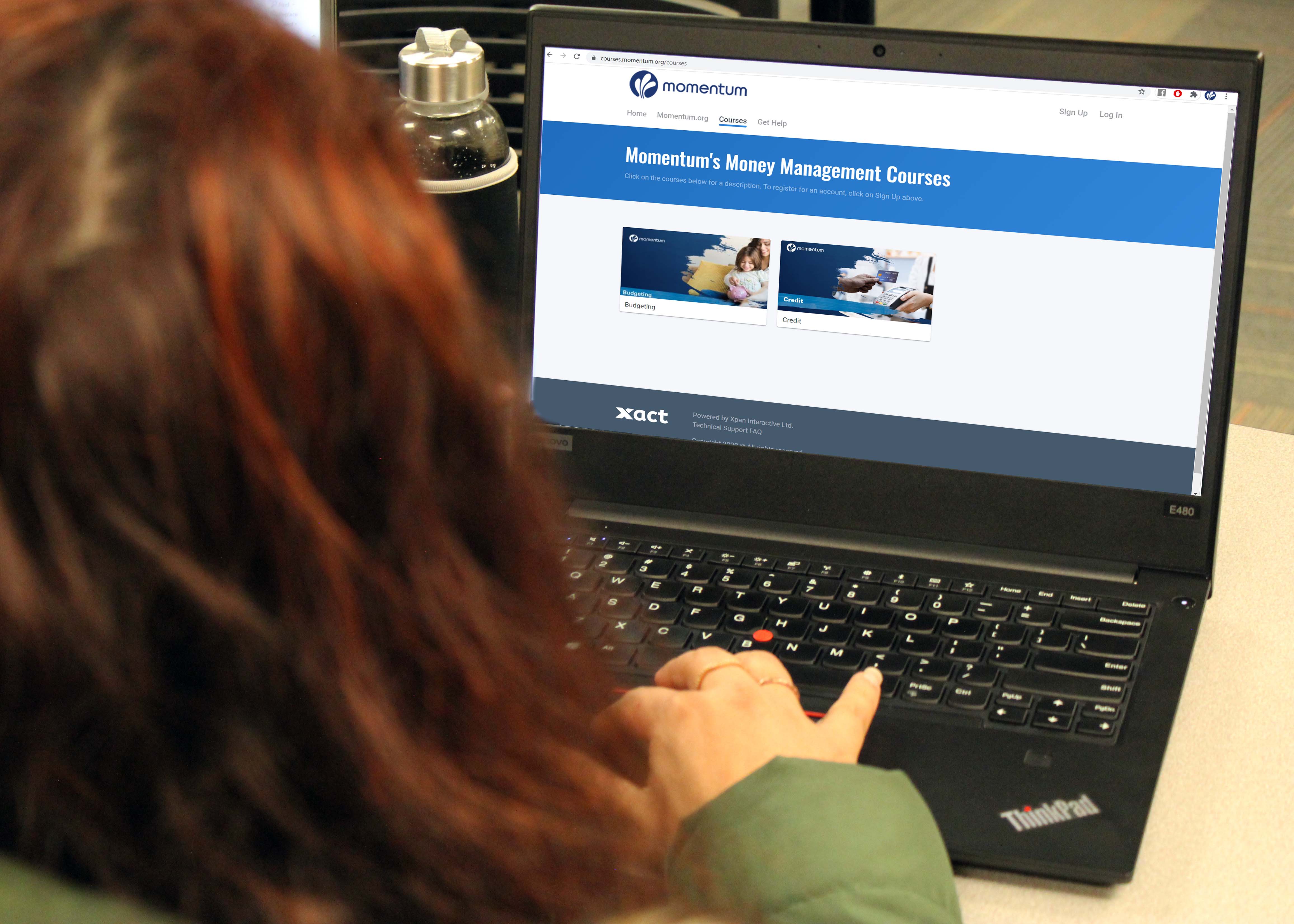

I’m a Financial Empowerment Facilitator at Momentum. I facilitate the money management program. I teach the five classes, focused on budgeting, credit, assets, consumerism and banking. These courses empower people to take control of their money, providing the knowledge and resources to develop a sustainable livelihood. I also teach Financial Literacy Training at Momentum.

Tell us about the financial literacy side of Momentum.

Financial Literacy is one of the pillars of reducing poverty. When you have financial literacy knowledge, it allows you to engage in commerce in a way that supports you and your family. Financial Literacy with Momentum empowers folks to gain the confidence and to use the skills and knowledge they already have in order to make positive changes in their life.

Why do you do the work that you do?

Momentum is part of the Enough For All Poverty reduction strategy. At Momentum, everything we do is grounded in a community economic development approach. We do this work because we believe everyone has a contribution to make to society, and we want to inspire vibrant communities where everyone plays a role.

What does success look like for your programs?

Success looks like giving folks the confidence and the skills to take control of their money and their lives.

What have you learnt from your work that you would like other people to know?

That financial literacy is for everyone. It’s a skill that is lacking in the Canadian economy. I have learned that we really need to make financial literacy a dinner table conversation, because people just don’t talk about finances. The saying goes that as Canadians, we don’t talk about religion, we don’t talk about politics, and we don’t talk about money. The only way we’re going to change this is through meaningful conversations that encourage a better understanding of finances and what’s happening in the world.

Anything else we should know?

All our programming is free and accessible through online learning or in person learning. We want to give folks the tools to succeed in their lives. To find out which programs are currently accepting new participants:

– Visit the website at: www.momentum.org

– Visit the office at: 100, 525 28 St SE, Calgary, Alberta, T2A 6W9 (Monday to Friday 8:30am-4:30pm)

– Phone: 403-272-9323

– Email: info@momentum.org

Momentum also offers training for organizations in financial literacy, financial coaching and more. Check out the website for details!